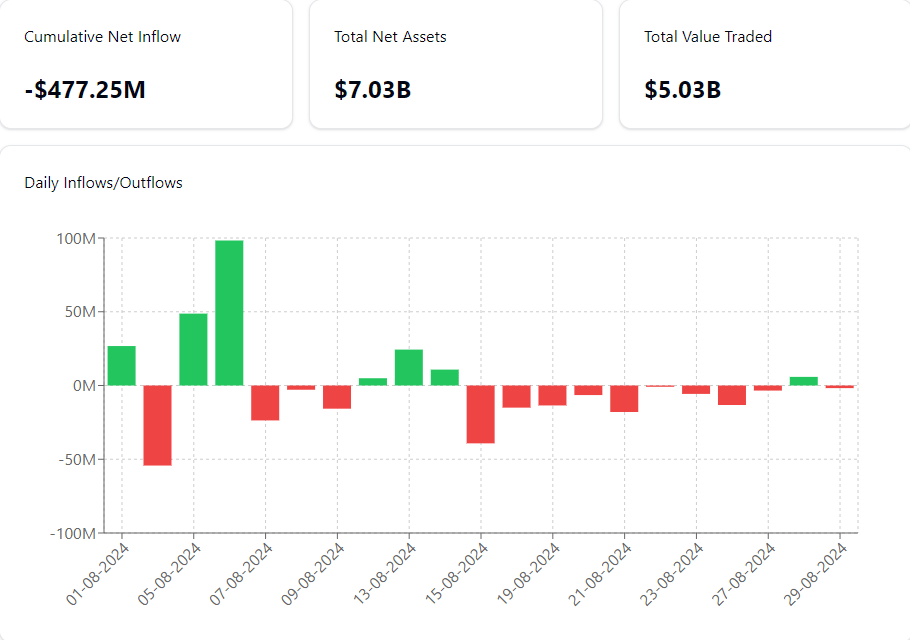

The data provided covers Ethereum spot ETF flows from August 1, 2024, to August 30, 2024. This analysis will focus on key trends in daily inflows, cumulative net inflows, trading volumes, and total net assets.

Key Observations

1. Net Inflows

- The cumulative total net inflow has been consistently negative throughout the period, ending at -$477M on August 29, 2024.

- This suggests a general trend of outflows from Ethereum spot ETFs during this timeframe.

2. Daily Inflows

- Daily inflows have been volatile, with significant swings between positive and negative values.

- The largest single-day inflow was on August 6, 2024, with $9,83,00,642.40.

- The largest single-day outflow was on August 15, 2024, with -$3,92,11,084.20.

3. Trading Volume

- The total value traded shows considerable day-to-day variation.

- The highest trading volume was observed on August 5, 2024, with $71,51,93,987 worth of trades.

- The lowest trading volume was on August 22, 2024, with $9,38,70,209.70.

4. Total Net Assets

- Total net assets have fluctuated but generally remained above $7 billion throughout most of the period.

- The highest recorded total net assets were on August 2, 2024, at $8,33,15,06,907.

- There was a noticeable dip in total net assets on August 7, 2024, to $6,62,60,86,498.72.

Trends and Implications

- Persistent Outflows: The consistent negative cumulative net inflow suggests that investors have been generally withdrawing funds from Ethereum spot ETFs during this period. This could indicate a bearish sentiment or a shift in investment strategies.

- Volatility in Daily Flows: The significant swings in daily inflows and outflows point to a high level of investor activity and potentially rapidly changing market sentiments.

- Fluctuating Trading Volumes: The variable trading volumes suggest periods of both high and low investor interest. This could be influenced by market news, overall crypto market conditions, or specific events related to Ethereum.

- Recent Trend: In the last few days of the data (August 27-29), there seems to be a slight reduction in the pace of outflows, with smaller negative or even positive daily inflows. This could potentially indicate a stabilizing trend, though more data would be needed to confirm this.

Conclusion

The Ethereum spot ETF market shows signs of investor caution with persistent outflows, but maintains a substantial asset base. Future performance may depend on broader cryptocurrency market trends, Ethereum-specific developments, and overall investor sentiment towards crypto assets.